Oklahoma’s total loss threshold is a crucial aspect of vehicle insurance claims after an accident. It determines whether your vehicle is considered a “total loss” by insurance companies. This declaration hinges on the cost of repairs exceeding a certain percentage of the vehicle’s actual cash value (ACV). Knowing how this threshold works can save you time, money, and frustration when dealing with insurance companies after an accident.

What is the Oklahoma Total Loss Threshold?

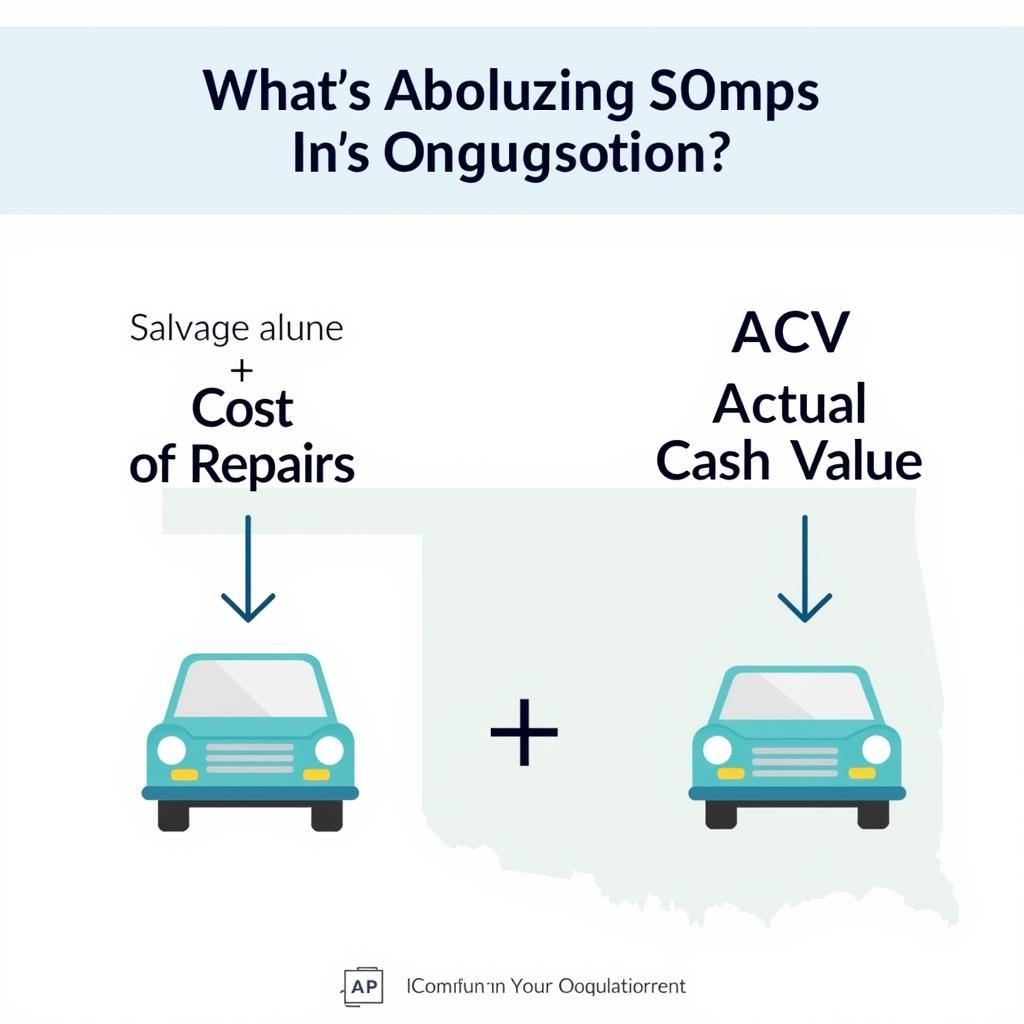

Oklahoma uses a “Total Loss Formula” to determine whether a vehicle is a total loss. This formula considers both the cost of repairs and the vehicle’s salvage value. Generally, if the cost of repairs plus the salvage value equals or exceeds the vehicle’s actual cash value (ACV), the vehicle is deemed a total loss.

How is the Actual Cash Value (ACV) Determined?

The ACV represents the fair market value of your vehicle right before the accident. Insurance companies typically determine ACV by considering factors like the vehicle’s year, make, model, mileage, condition, and pre-existing damage. It’s important to note that the ACV isn’t necessarily what you paid for the car or what you owe on a loan.

Oklahoma Total Loss Threshold Calculation

Oklahoma Total Loss Threshold Calculation

What if I Disagree with the Insurance Company’s ACV Assessment?

Don’t hesitate to negotiate with the insurance company if you believe their ACV assessment is too low. Provide supporting evidence such as recent appraisals, sales listings of similar vehicles, and repair estimates from independent mechanics. Being prepared with documentation can significantly strengthen your position.

Understanding Salvage Titles in Oklahoma

When a vehicle is declared a total loss, it receives a salvage title. This title brands the vehicle as having been significantly damaged and unsuitable for regular road use without extensive repairs. Driving a salvaged vehicle without proper repairs can be illegal and unsafe.

Can a Salvaged Vehicle Be Repaired and Retitled?

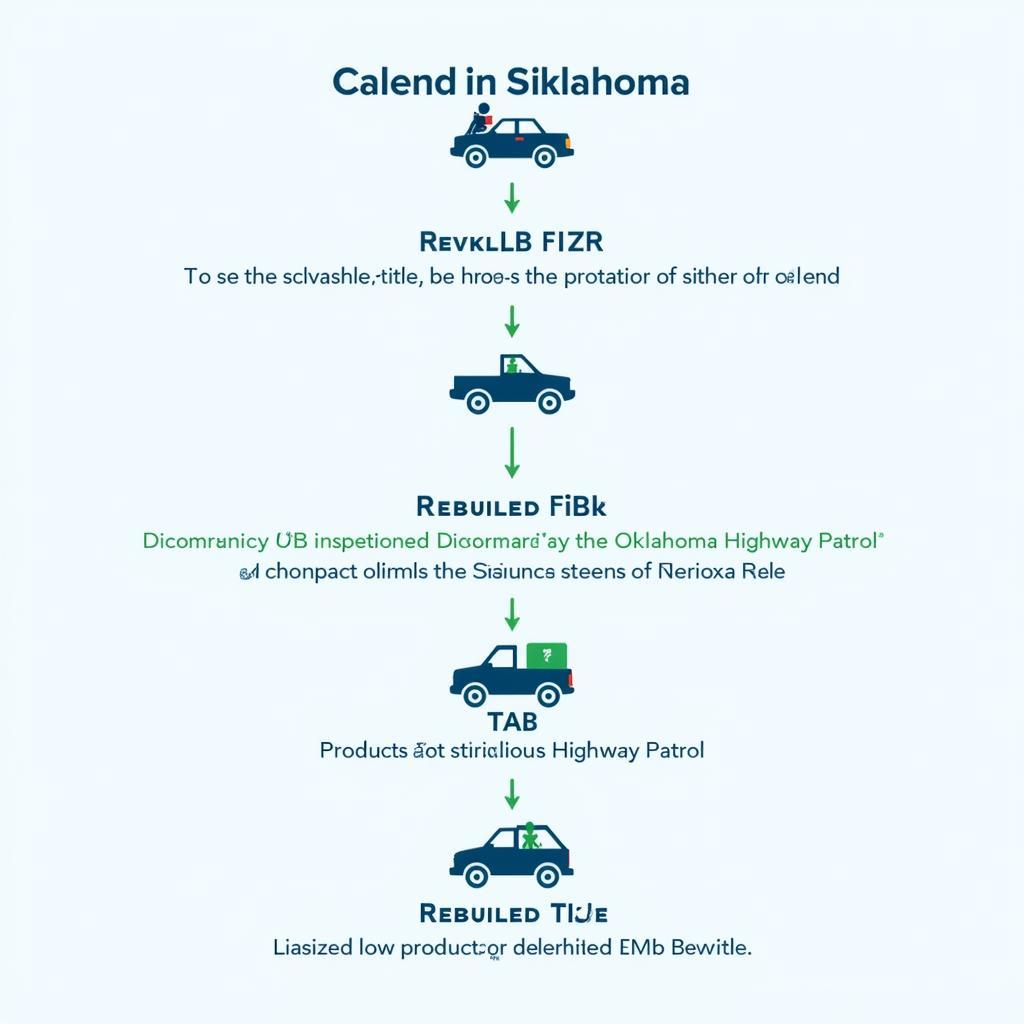

Yes, a salvaged vehicle can be repaired and retitled in Oklahoma. However, this involves a thorough inspection process by the Oklahoma Highway Patrol to ensure the vehicle meets safety standards. Once the inspection is passed, a rebuilt title will be issued, allowing the vehicle to be legally driven again.

Oklahoma Salvage Title Process

Oklahoma Salvage Title Process

Negotiating with Insurance Companies After a Total Loss

Negotiating with insurance companies after a total loss can be challenging. Remember, you have the right to negotiate the settlement offered. Understanding the Oklahoma Total Loss Threshold and how ACV is calculated is crucial for a successful negotiation.

Tips for Negotiating a Fair Settlement:

- Research your vehicle’s ACV: Use online resources and local dealerships to determine a fair market value.

- Document everything: Keep records of all communication, repair estimates, and supporting evidence.

- Be assertive but polite: Clearly communicate your expectations and be prepared to justify your position.

- Consider professional help: If you’re struggling to reach a fair agreement, consult with an attorney or public adjuster.

Negotiating with Insurance Companies

Negotiating with Insurance Companies

Conclusion: Protecting Your Rights After an Accident in Oklahoma

Understanding the Oklahoma total loss threshold is crucial for navigating the insurance claim process after an accident. Knowing how the ACV is calculated and what steps to take if your vehicle is declared a total loss empowers you to protect your rights and receive a fair settlement. Remember to thoroughly research, document everything, and be assertive throughout the negotiation process. If you need further assistance, don’t hesitate to contact us.

Frequently Asked Questions (FAQ)

- What if my car is worth less than the loan balance after a total loss?

- How long does the total loss process take in Oklahoma?

- Can I keep my totaled car and receive the settlement?

- What factors affect my vehicle’s salvage value?

- How do I find a qualified mechanic to assess the damage?

- What are the requirements for getting a rebuilt title in Oklahoma?

- How can I avoid being lowballed by the insurance company?

Need assistance? Contact us: Phone: 0902476650, Email: [email protected] or visit our address: 139 Đ. Võ Văn Kiệt, Hoà Long, Bà Rịa, Bà Rịa – Vũng Tàu, Việt Nam. We have a 24/7 customer support team.