Mvp Tax is a term used to describe the additional costs, time, and effort associated with building a Minimum Viable Product (MVP). While an MVP is designed to be lean and efficient, it’s crucial to understand that there are inherent trade-offs that can lead to this “tax.” This guide will delve into the different facets of MVP tax, exploring its causes, consequences, and strategies to minimize its impact.

What Contributes to MVP Tax?

Several factors contribute to the overall cost of MVP tax. These include technical debt, design debt, and marketing debt. Technical debt arises from taking shortcuts in development to speed up the launch. Design debt refers to compromises made in user experience and design for the sake of expediency. Marketing debt, meanwhile, accumulates when marketing efforts are deferred or under-resourced during the initial MVP launch.

Technical Debt: The Hidden Costs of Speed

Often, to get an MVP to market quickly, developers may opt for simpler solutions that are not necessarily scalable or maintainable in the long run. This creates technical debt, which can manifest as bugs, performance issues, and difficulties in adding new features later on. Think of it like building a house on a weak foundation – while it might stand initially, it’s likely to cause problems down the line.

Technical Debt in MVP Development

Technical Debt in MVP Development

Design Debt: Sacrificing UX for Speed

Just as with technical debt, design debt arises from prioritizing speed over user experience. This can involve using a less-than-ideal user interface, neglecting user testing, or postponing important design elements. While this might be acceptable in the early stages, ignoring design debt can lead to user frustration and ultimately hinder adoption.

Marketing Debt: Delaying the Promotional Push

Many startups choose to focus their initial resources on development, leaving marketing efforts until after the MVP launch. This creates marketing debt, which can make it difficult to gain traction and reach the target audience once the product is ready. Imagine building a fantastic product but nobody knows about it – that’s the essence of marketing debt.

Minimizing MVP Tax: Strategies for Success

While MVP tax is unavoidable to some extent, there are strategies to mitigate its impact. Careful planning, prioritizing core features, and adopting an iterative approach are key.

Prioritize Core Features: Focus on the Essentials

By focusing on the core features that deliver the primary value proposition, you can reduce the scope of the MVP and minimize the potential for accumulating technical and design debt. This involves identifying the must-have features and ruthlessly cutting anything that isn’t essential for the initial launch.

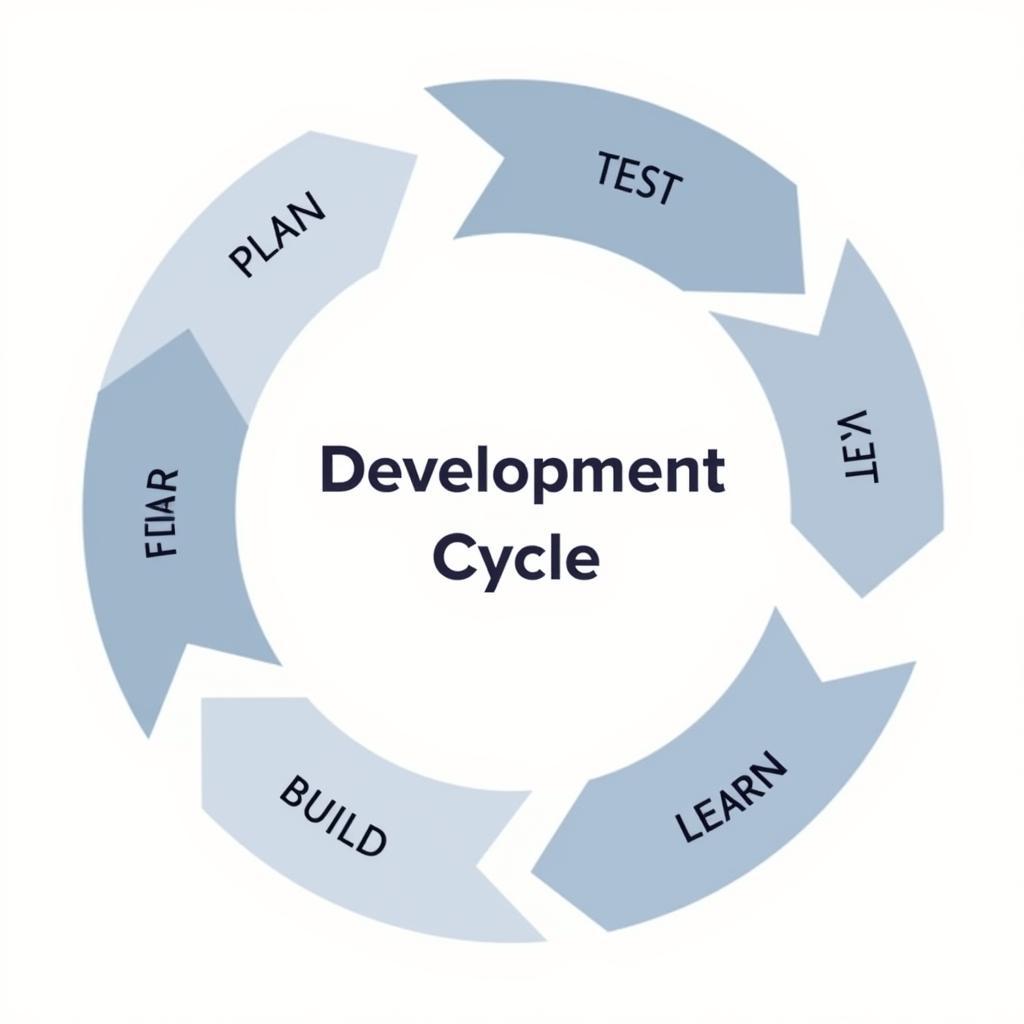

Iterative Development: Building in Stages

An iterative approach allows you to address technical and design debt incrementally. By releasing updates and incorporating user feedback, you can refine the MVP over time, gradually reducing the accumulated “tax.” This is like building a house room by room, ensuring each part is solid before moving on to the next.

Iterative Development Cycle for MVP

Iterative Development Cycle for MVP

Conclusion: Navigating the MVP Landscape

MVP tax is a reality for any startup developing a Minimum Viable Product. However, by understanding its causes and implementing strategies to minimize its impact, you can navigate the challenges and build a successful product. While shortcuts might seem tempting in the short term, remember that investing in quality from the beginning can save you significant time and resources in the long run. Don’t let MVP tax derail your project – plan strategically and build a solid foundation for future growth.

FAQ: Common Questions about MVP Tax

-

What is the biggest misconception about MVPs?

A common misconception is that MVPs are incomplete or low-quality products. In reality, they are strategically designed to test key assumptions and gather user feedback. -

How can I estimate the potential MVP tax for my project?

Estimating MVP tax is challenging, but consider factors like the complexity of your product, the development team’s experience, and the potential for design iterations. -

Is it ever advisable to ignore MVP tax entirely?

Ignoring MVP tax entirely is not recommended. While some debt is inevitable, completely disregarding it can lead to long-term problems with scalability and maintainability. -

What are some common mistakes startups make when building MVPs?

Common mistakes include overbuilding, neglecting user feedback, and failing to prioritize core features. -

How can I convince stakeholders to invest in reducing MVP tax?

Highlight the long-term costs of technical and design debt. Explain how addressing these issues early can save time and money in the future. -

How does MVP tax impact the overall product lifecycle?

MVP tax can significantly impact the product lifecycle. High technical debt, for instance, can make it difficult and costly to add new features or scale the product later on. -

What are the key metrics to track when assessing MVP tax?

Key metrics include bug reports, user feedback, development time for new features, and the cost of fixing technical issues.

Need More Help?

For further assistance and expert advice, please contact us:

Phone: 0902476650

Email: [email protected]

Address: 139 Đ. Võ Văn Kiệt, Hoà Long, Bà Rịa, Bà Rịa – Vũng Tàu, Việt Nam.

Our customer support team is available 24/7. We also have a wealth of resources available on our website, including articles on game development, marketing strategies, and more. Check out our blog for more helpful tips and insights!