When making online payments or verifying your identity, you might encounter the terms “MCC” and “MCC Plus 4.” While they sound similar, they serve distinct purposes. Understanding the difference between MCC and MCC Plus 4 can help you navigate online transactions with confidence.

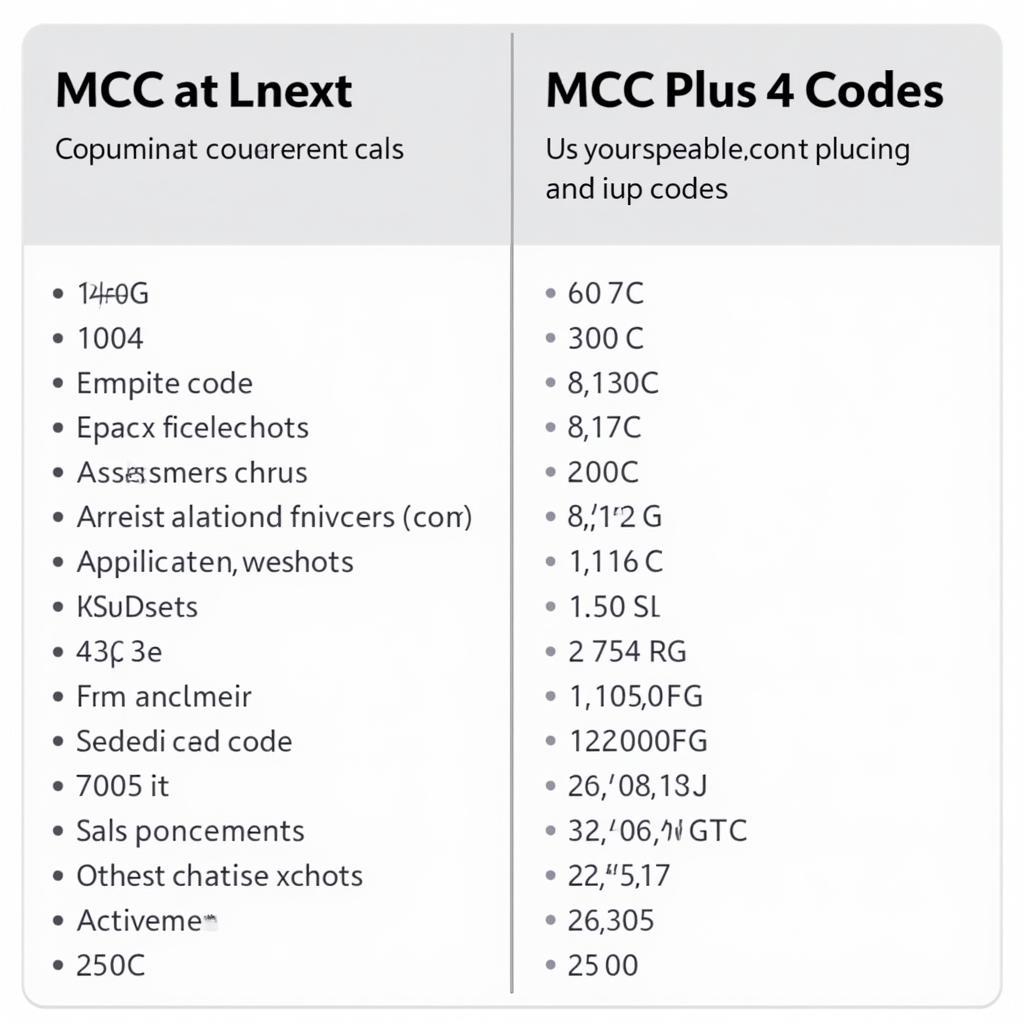

MCC vs. MCC Plus 4 Comparison Table

MCC vs. MCC Plus 4 Comparison Table

Decoding MCC: The Merchant Category Code

MCC stands for Merchant Category Code, a four-digit number assigned to businesses by credit card companies like Visa, Mastercard, and American Express. This code categorizes businesses based on the type of goods or services they provide. For example, a restaurant might have an MCC of 5812, while a clothing store would have a different code.

But why is this important for you as a consumer?

- Fraud Prevention: MCCs help credit card companies track spending patterns and flag potentially fraudulent activities.

- Reward Programs: Some credit cards offer bonus rewards or cashback for specific MCCs, such as gas stations or grocery stores. Knowing the MCC of a business can help you maximize your rewards.

However, the MCC alone can be broad. A single MCC might encompass various business types, making it difficult to pinpoint the exact nature of a transaction. This is where MCC Plus 4 comes into play.

What is MCC Plus 4?

As the name suggests, MCC Plus 4 adds an additional layer of specificity to the standard MCC. It consists of the four-digit MCC followed by a four-digit sub-category code, creating an eight-digit identifier. This extra information paints a clearer picture of the transaction.

Let’s illustrate with an example:

- MCC 5411: This code signifies “Grocery Stores, Supermarkets.”

- MCC 5411 0001: This code narrows down the category to “Supermarkets” specifically.

This granularity allows for more accurate transaction categorization and analysis.

When Does MCC Plus 4 Matter?

While you might not often encounter the term “MCC Plus 4” directly, it plays a vital role behind the scenes:

- Enhanced Security: The added specificity helps financial institutions detect and prevent fraudulent transactions more effectively.

- Targeted Rewards: Some credit card companies use MCC Plus 4 data to offer hyper-targeted rewards programs.

- Business Insights: Merchants can use MCC Plus 4 data to analyze sales trends and customer behavior with greater precision.

Frequently Asked Questions

1. Do I need to know the MCC or MCC Plus 4 code for a business before making a purchase?

No, you don’t need to know these codes to complete a transaction. They are primarily used for behind-the-scenes processing and analysis.

2. How can I find out the MCC or MCC Plus 4 code for a specific business?

You can usually find this information by contacting your credit card company or searching online databases. However, keep in mind that these codes can sometimes change.

3. Can the MCC or MCC Plus 4 code affect my credit card rewards?

Yes, some credit card companies offer bonus rewards based on specific MCCs. Knowing the code can help you determine if a purchase qualifies for additional rewards.

Need Further Assistance?

For any questions or concerns regarding MCC, MCC Plus 4, or any other payment-related queries, please don’t hesitate to contact our dedicated customer support team:

Phone: 0902476650

Email: [email protected]

Address: 139 Đ. Võ Văn Kiệt, Hoà Long, Bà Rịa, Bà Rịa – Vũng Tàu, Việt Nam

Our team is available 24/7 to assist you with your gaming needs.