The CFA build up approach is a fundamental valuation method used to determine the intrinsic value of a company. Unlike other methods that rely heavily on market comparisons or past performance, this approach focuses on building a comprehensive picture of the company’s future earning potential by meticulously analyzing its various components.

Understanding the CFA Build Up Method

Understanding the CFA Build Up Method

Deconstructing the CFA Build Up Approach

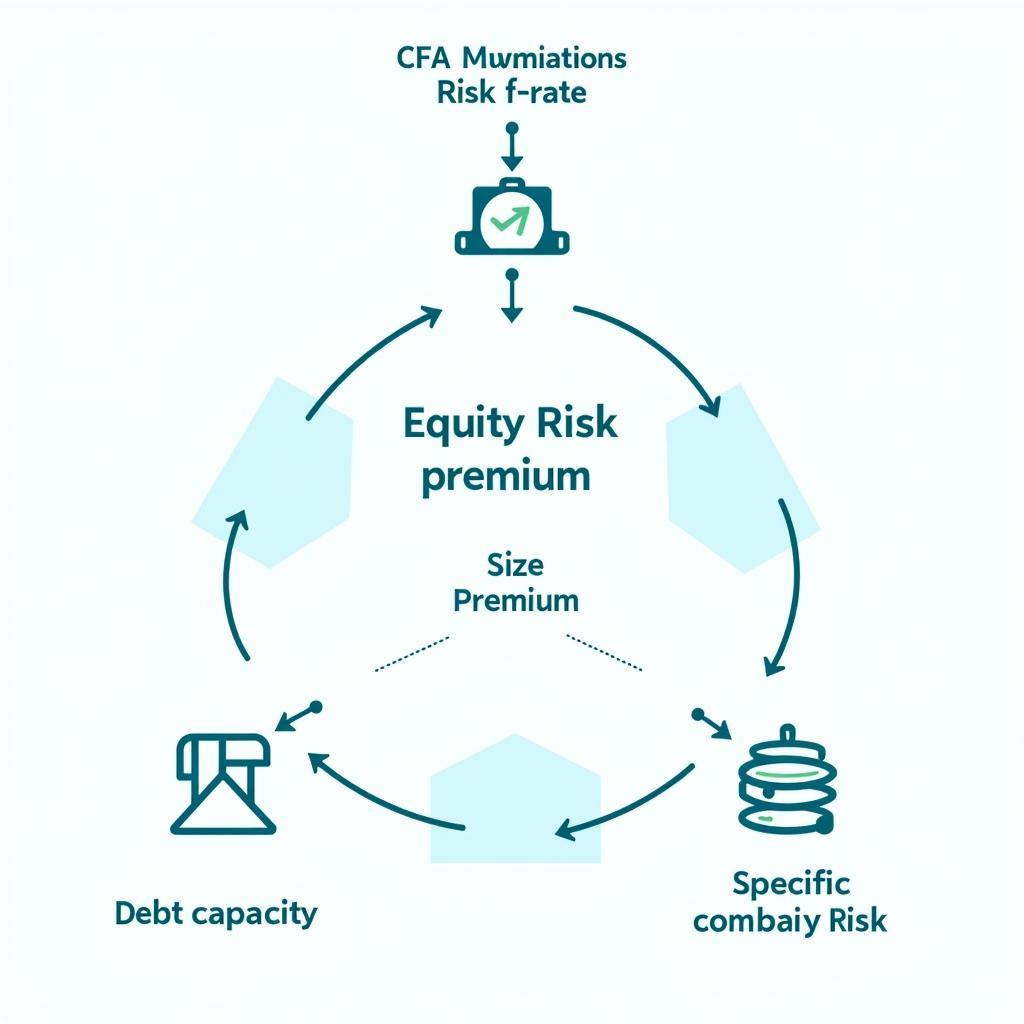

At its core, the build-up method breaks down the required rate of return on an equity investment into several key components:

- Risk-Free Rate: This forms the foundation of the calculation and represents the return an investor could expect from a completely risk-free investment, such as a government bond.

- Equity Risk Premium: Recognizing that investing in equities carries inherent risks, this premium accounts for the additional return investors demand for holding stocks over risk-free assets.

- Size Premium: Empirical evidence suggests that smaller companies tend to outperform larger ones over the long term. This premium factors in the potential for higher returns associated with investing in smaller-sized companies.

- Specific Company Risk: Each company carries its own unique set of risks, influenced by factors such as industry dynamics, management competence, and competitive positioning. This component captures the additional risk associated with investing in a particular company.

- Debt Capacity: A company’s debt level influences its risk profile. Higher debt generally translates to greater financial risk, potentially impacting its future earnings and valuation.

By meticulously analyzing and quantifying each of these components, analysts can build a customized required rate of return for a specific company, leading to a more accurate assessment of its intrinsic value.

Implementing the Build Up Approach: A Step-by-Step Guide

- Determine the Risk-Free Rate: The starting point involves identifying a suitable risk-free rate. This typically involves using the yield on a long-term government bond that aligns with the investment horizon.

- Estimate the Equity Risk Premium: Various models can be employed to estimate the equity risk premium. A commonly used method is the historical premium approach, which analyzes historical differences in returns between stocks and government bonds.

- Factor in the Size Premium: Determining the appropriate size premium often involves referring to historical data or published studies that provide insights into size-based return differentials.

- Assess Specific Company Risk: This step requires a deep dive into the company’s financials, industry landscape, competitive positioning, and management quality to identify and quantify potential risks.

- Consider Debt Capacity and Financial Risk: Analyzing the company’s debt levels, interest coverage ratios, and overall financial health provides insights into its financial risk profile. This information guides the adjustment for debt capacity in the build-up approach.

Advantages of the Build Up Approach

The CFA build up approach offers several advantages over other valuation methods:

- Customization: This approach allows for a high degree of customization, capturing the unique risk and return characteristics of each company.

- Forward-Looking: Unlike methods that rely heavily on past data, the build-up approach encourages a forward-looking perspective, considering future growth prospects and potential risks.

- Transparency: The method provides a clear and transparent breakdown of the factors influencing a company’s valuation, making it easier to understand and communicate investment decisions.

Limitations to Consider

While powerful, the build-up approach is not without limitations:

- Subjectivity: Some degree of subjectivity is inherent in the process, particularly when estimating risk premiums and specific company risk.

- Data Dependency: The accuracy of the valuation relies heavily on the quality and availability of data, which can be challenging to obtain, especially for smaller or less established companies.

- Dynamic Nature of Risk: Risk profiles are not static and can change rapidly due to various factors. The build-up approach requires continuous monitoring and adjustments to reflect these changes.

Conclusion

The CFA build up approach offers a robust and flexible framework for valuing companies. By meticulously analyzing risk factors and growth opportunities, investors can gain a deeper understanding of a company’s intrinsic worth. While the method involves complexities and requires careful consideration of its limitations, when applied diligently, it can be a valuable tool in making informed investment decisions.

For any inquiries or assistance with your investment strategy, please do not hesitate to contact us. Our team of experts at VNG Game is available 24/7 to provide guidance and support. You can reach us at Phone Number: 0902476650, Email: [email protected] or visit our office at 139 Đ. Võ Văn Kiệt, Hoà Long, Bà Rịa, Bà Rịa – Vũng Tàu, Vietnam.