The 4 Jar method, a simple yet effective personal finance strategy, is gaining traction among those seeking to manage their money wisely. This article delves into the intricacies of this method, exploring its benefits, providing practical implementation steps, and addressing common queries.

Understanding the 4 Jar Method

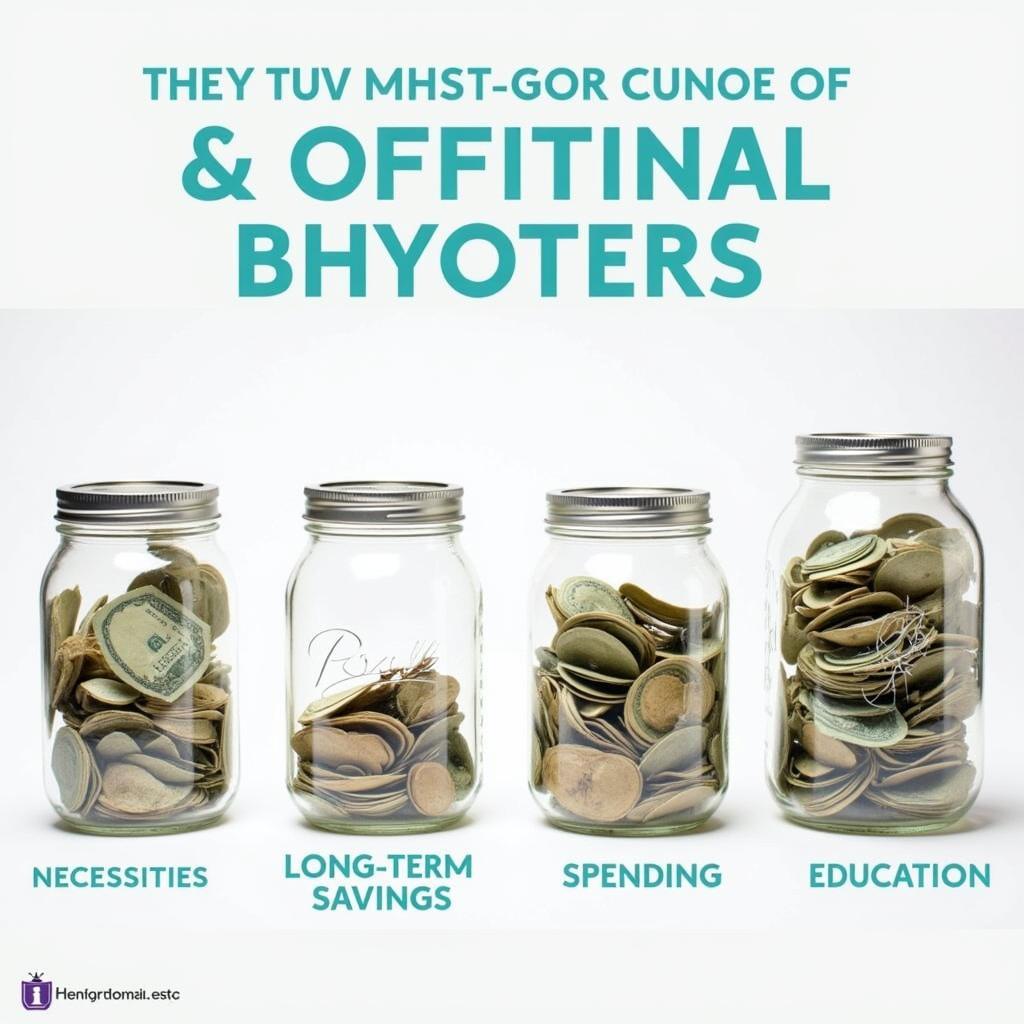

The 4 jar method involves dividing your income into four separate jars, each dedicated to a specific purpose: Necessities (55%), Long-term Savings (10%), Spending (10%), and Education (25%). This segregation allows for clear allocation and controlled expenditure. Think of it as a visual representation of your budget, making it easier to track and manage your finances.

After the first paragraph, let’s dive into more details about the Jared Goff Madden 24 rating. jared goff madden 24

Breaking Down the Jars

Each jar plays a crucial role in achieving financial balance. The Necessities jar covers essential expenses like rent, utilities, and groceries. The Long-term Savings jar is for future investments, emergencies, or large purchases. The Spending jar allows for guilt-free enjoyment, funding entertainment and leisure activities. Finally, the Education jar invests in personal and professional growth, encompassing courses, books, and skill development.

Necessities (55%): The Foundation of Your Budget

This jar forms the bedrock of your financial stability, addressing your essential needs. Careful budgeting within this category is crucial. Think of consistent, predictable expenses.

Long-Term Savings (10%): Securing Your Future

Building a financial safety net is paramount. Regular contributions to this jar create a buffer for unforeseen circumstances and contribute to long-term goals.

Spending (10%): Enjoying the Present

While saving is essential, enjoying the present is equally important. This jar ensures guilt-free spending on leisure and entertainment, promoting a balanced lifestyle. What are some fun things you could do with your spending jar money?

4 Jar Method: Spending and Savings Jars

4 Jar Method: Spending and Savings Jars

Education (25%): Investing in Yourself

Continuous learning is an investment in your future. This jar facilitates personal and professional development, leading to increased earning potential and overall growth. This might include anything from online courses to professional certifications. Do you have a favorite website for finding educational resources? Perhaps you’re interested in Sims 4 long hair options? sims 4 long hair

Implementing the 4 Jar Method

Implementing this method is straightforward. Start by calculating your monthly income. Then, divide your income according to the specified percentages for each jar. You can use physical jars, envelopes, or digital accounts to separate the funds. Regularly track your spending and adjust the percentages as needed.

Benefits of the 4 Jar Method

This method simplifies budgeting, promotes disciplined spending, encourages saving, and prioritizes personal growth. It provides a clear overview of your financial situation and empowers you to make informed decisions. It’s a visual and tangible way to see where your money is going.

John Doe, a financial advisor, emphasizes the importance of this method: “The 4 jar method provides a structured approach to managing finances, especially for those new to budgeting. It encourages consistent saving and conscious spending.”

4 Jar Method: All Four Jars

4 Jar Method: All Four Jars

Jane Smith, a seasoned budgeter, adds, “This method helped me gain control of my finances. I now have a clear picture of my spending habits and feel more secure about my future.” Check out information regarding Sims mermaid tails. sims jaru sims mermaid7 tail It might spark some creative ideas for your spending jar!

Conclusion

The 4 jar method offers a simple yet effective way to manage personal finances. By dividing your income into designated categories, you can track your spending, prioritize savings, and invest in your future. This method empowers you to take control of your financial well-being and achieve your goals. Ready to get started? More on the 4M message board here: 4m message board And if you’re interested in football, here’s an article on Jared Goff’s arm strength: jared goff arm strength

FAQ

- What if my income fluctuates each month?

- Can I adjust the percentages for each jar?

- What are some good digital tools for implementing this method?

- How often should I review my spending and adjust my budget?

- What if I have debt? How does that fit into this system?

- Is this method suitable for everyone?

- How can I stay motivated to stick to this method?

For support, contact us at Phone: 0902476650, Email: [email protected] or visit us at 139 Đ. Võ Văn Kiệt, Hoà Long, Bà Rịa, Bà Rịa – Vũng Tàu, Việt Nam. We have a 24/7 customer support team.